How to Build A Trading Robot |

Beginner's Guide

Editorial Note: While we adhere to strict Editorial Integrity, this post may contain references to products from our partners. Here's an explanation for How We Make Money. None of the data and information on this webpage constitutes investment advice according to our Disclaimer.

How to write code for a trading robot:

Building a trading bot may seem like a daunting task, but with the right tips, it’s achievable. Trading bots, or automated trading systems, allow you to execute trades based on pre-set strategies. This eliminates the need for constant monitoring and manual intervention. We offer a step-by-step breakdown of how to build your own trading bot: from choosing the right platform and programming language to coding, testing, and optimization. Whether you’re new to programming or just starting out with algorithmic trading, this guide will help you lay the foundation for building a bot that’s tailored to your trading style.

How to write code for a trading robot

A trading robot is software for automating the process of trading in financial markets. It analyzes market data and automatically executes trades based on specified algorithms and strategies. Using trading robots allows traders to quickly respond to market changes and minimize the influence of the human factor.

There are two main types of trading robots:

Automatic — completely independently analyze the market and execute trades without the participation of the trader.

Semi-automatic (advisers) — provide recommendations on trades, leaving the final decision to the trader.

You have three ways to create a trading robot:

Option 1: Contact a specialist

You can find programmers to write a trading robot on MQL5 platforms or freelance exchanges.

Pros:

Quick implementation of the idea;

The ability to choose a specialist.

Option 2: Write the code yourself

This path is suitable for those who want to learn the process of creating a robot. Even a simple bot can be written after basic training, and available online resources will help develop skills.

Pros:

The ability to implement ideas one by one;

Understanding the work of the robot at the code level;

Maintaining complete confidentiality of the idea.

Option 3: Use a code generator

Creating a trading robot for MetaTrader 4 can be streamlined using online code generators. These platforms allow you to develop a simple trading robot in the ex4 format, compatible with MT4.

The process typically involves:

Adding indicators. Select the technical indicators that will inform your trading decisions.

Creating conditions. Define the specific criteria or rules that will trigger trades based on the chosen indicators.

Implementing a capital management strategy. Establish guidelines for managing trade sizes, risk levels, and overall capital allocation.

Exporting the trading robot. Generate the final ex4 file, which can be uploaded to your MT4 platform for execution.

Advantages:

You will quickly get your robot if it can be implemented using the existing functionality in the designer.

Many of these tools are free, making them accessible for traders without programming skills.

Where to start

You should start by searching for ideas. For example:

you notice that the market often makes false breakouts of round levels;

you have discovered dependencies in the interaction of price and trading volumes;

you read a description of a trading strategy in a book.

If the idea can be clearly outlined in step-by-step instructions, it can be turned into program code.

Which brokerage account is best for bots?

Once you have your trading bot code set up, integrate it with an appropriate trading platform. This could be a platform like TradingView, a Forex broker, or a cryptocurrency exchange, depending on your trading preferences. The platform should also support API integration, bot connectivity, low fees, and ECN liquidity to ensure consistent spreads and minimal slippage.

| ECN Spread EUR/USD | ECN Commission | API | Trading bots (EAs) | Free VPS | Open an account | |

|---|---|---|---|---|---|---|

| No | No | No | Yes | No | Open an account Your capital is at risk. |

|

| 0,1 | 3 | Yes | Yes | Yes | Open an account Your capital is at risk.

|

|

| 0,15 | 3,5 | Yes | Yes | Yes | Open an account Your capital is at risk. |

Testing and optimizing history

After creating a robot, it is necessary to conduct testing (backtesting) and optimize its parameters.

Backtesting means testing the robot on historical data. This means that you take data from, say, 2017-2019 and look at the trades that the robot would have made according to the rules in that period from the past. The trade data is then processed and presented in the form of a report that shows:

The number of trades executed.

Total profit or loss.

Profit-to-loss ratio.

Additional metrics to assess the robot's quality.

To open the testing panel in MT4, press Ctrl+T.

After that, you:

Select the robot you will test. The ex4 file of the robot should be in the MQL4Experts folder. In the example above, we selected the robot trading on moving averages. It comes with the MT 4 terminal.

Select the trading pair you will test. For example, you can select EUR/USD.

Select the testing accuracy (the more accurate, the more time it will take to test).

Select the testing period. The more historical data is processed, the more reliable the result will be.

Select the timeframe (5).

Specify the spread value (the difference between the purchase and sale prices). Current means that the spread value will be loaded automatically.

Select the robot parameters. For example, moving average periods, the size of the initial deposit.

Run the test. The Results tab will show the trades made by the robot during testing.

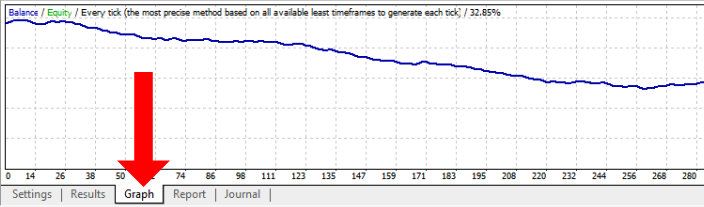

As a result, if you have done everything correctly, with a high probability you will get the following picture on the Graph tab:

This means that the trading robot is slowly losing the deposit because:

Mathematical probability of profit = 50/50;

The final loss occurs due to the spread (commission) that is paid for each transaction.

To try to correct this result, you can try to "play" with the periods of the moving average, time frame, currency pairs. But all these "games" will not give the desired result over a long distance, most likely.

But it is quite possible that after numerous experiments with strategies and optimization (searching for the best settings for the trading robot), you will see an impressive curve, as in the figure below.

The Report tab gives you more detailed information.

In the example above, the report says the following:

Test accuracy = 99.9% and test errors = 0. This is a high confidence, and can be achieved with a quality price database.

With 9,395 trades, the bot managed to grow the initial $20,000 to $1.1 million between February 2019 and January 2023.

The relative drawdown = 40% is certainly high. And in real life, it would be nerve-wracking.

Optimize to find parameters on one period (for example, on data for 2015-2018) and test them on another (for 2019-2023). This is called direct testing.

It is worth remembering that you cannot rely on the testing results 100%. The fact is that you will not be able to fully simulate real conditions and take into account slippage, changes in spreads. A big problem is the granularity of data for one minute, which is the smallest time frame in the MetaTrader environment. But how the price changes during the minute can determine whether the trade will close at take profit or stop. In fact, MT4 simplifies what happens during the minute to optimize the database, and the terminal works faster.

But a professional needs to achieve maximum accuracy, so he buys large tick databases for almost 20 years, which your broker will most likely not provide you with. "Smoothed" historical data from your broker can be the reason why the robot shows profit in history and suffers losses in real time.

Testing on a demo account

Once you have completed testing and optimization of the robot, do not rush to switch to a real account. First, test it on a demo account for a few months. This will allow the robot to go through periods of significant news and identify possible improvements.

What to pay attention to:

Hardware and connection: make sure that your equipment and Internet connection do not interfere with the robot's operation. To minimize risks, it is worth considering using a VPS.

Code quality: after observing the results, you will probably want to make changes to the code to take into account more market situations.

Broker quality: use demo accounts of different brokers to understand whether their choice affects the robot's efficiency.

Suppose that the robot made 40 trades on a demo account in 4 months, increasing the deposit by 7.45% with a drawdown of 6%. Run it in historical testing mode for the same period to check how the results match. Small discrepancies between the results are normal. It is important that the difference is minimal; in this case the results can be considered reliable.

Launch on a real account

If you have done everything correctly and reached this step, then objectively you are great. Because beginners are usually too quick to put hastily obtained trading robots on a real account to make a profit as quickly as possible. Unfortunately, this method is fraught with the loss of deposits. The main thing is caution and protection of your capital. If you are trading a robot on a real account, start by allocating a small amount of money for your early test trades.

Then see if the results on the real account deviate from the results obtained on the demo account and history. Perhaps you will get a situation like the following:

Two accounts - demo and real - work in parallel with one reputable broker. But the demo account shows a profit, and the real account - a loss, although everything is identical there.

Typical for scalping robots that make deals during impulse price movements. The duration of transactions is measured in seconds, and the quality of execution becomes critical. It differs between real and demo accounts. Therefore, when developing your robot, strongly prefer ideas that are not related to scalping trades.

How to create a trading robot for MT4

Automated systems that execute trades for traders can be created using the MetaTrader 4 (MT4) platform. It has all the tools for programming. And this process can be condensed into six steps:

Define a strategy. First, determine the assets and approach to trading. Decisions on trading time and conditions based on fundamental and technical analysis will significantly affect the effectiveness of the robot.

Choose a programming language. MT4 supports MQL 4, which is popular for creating robots. For advanced features, you can use MQL 5, which is also suitable for the MT5 platform.

Learn the basics of MQL4. Master the concept of variables, syntax, and basic logic. Practice writing simple scripts will help deepen your understanding and improve your skills.

Write code. Synthesize the strategy into code. Set parameters for entering and exiting trades, money management, and variables for flexible customization.

Optimize the robot. Identify key metrics, backtest the algorithm to see how it works in simulated conditions.

Test on a demo account. Use a demo account to test the robot's performance on current market data. Once testing is successful, you can move on to real trading.

How much money can I make?

Be realistic, don't build castles in the sky and don't think that a simple strategy can make you rich. Here's data from a reputable site that sells expert-designed strategies for managing assets in the stock market. The "Performance" column shows returns of 6% to 18% per year. That's what's realistic.

Can a trading robot work in automatic mode?

Theoretically yes. But leaving it unattended is risky. It is advisable to test and optimize it on updated historical data over time so that the robot settings correspond to current market conditions. Markets change following global macroeconomic cycles.

Algo trader mistakes

When creating trading robots, beginners often make several common mistakes.

Over-reliance on historical performance. Assuming past success guarantees future profits can lead to overconfidence. Market conditions change, and strategies need to adapt.

Insufficient testing. Using robots on live accounts without thorough backtesting and demo trials can result in losses. Proper testing helps catch issues before risking real money.

Blind trust in “black box” strategies. Relying on systems without knowing how they work can be risky. It's important to understand a strategy’s mechanics to judge its potential.

Over-optimization. Fine-tuning a robot too much to fit historical data can lead to curve-fitting, where it works well in the past but fails in real markets. Keep strategies simple and reliable.

Choosing the wrong broker. Selecting brokers that don’t support algorithmic trading or have poor conditions can hurt results. Ensure the broker meets your trading needs.

Unrealistic profit expectations. Expecting quick gains, especially with scalping robots, can lead to disappointment and risky behavior. Set realistic goals and know the risks.

Ignoring market events. Running robots during major news releases can expose them to volatile, unpredictable moves. Use safeguards or pause trading at these times.

Martingale strategy misuse. This involves doubling the trade size after losses to recover with one win. It needs significant capital and can drain accounts quickly during losing streaks. This risky approach is generally not recommended.

It's crucial to delve into the nuances of market microstructure

To craft an effective trading robot, it's crucial to delve into the nuances of market microstructure. This involves understanding the mechanics of order flow, liquidity, and the behaviors of various market participants. By analyzing how large institutional orders influence price movements and identifying patterns in trade executions, you can develop algorithms that anticipate short-term market fluctuations more accurately than traditional technical indicators. This depth of insight allows your trading robot to make more informed decisions, enhancing its performance in live trading environments.

Another vital aspect is the integration of adaptive learning mechanisms within your trading robot. Incorporating machine learning models enables the system to evolve with changing market conditions. For instance, implementing reinforcement learning allows the robot to learn from its trading outcomes, continuously refining its strategies based on real-time feedback. This dynamic adaptability ensures that your trading robot remains robust and effective, even as market dynamics shift, providing a significant edge over static, rule-based systems.

Conclusion

Building a trading robot is an exciting process that opens up new possibilities for automated trading. Following the steps described, you will be able to build a basic model, test it, and gradually optimize it. It is important to remember that a good robot requires regular updates and adaptation to changing market conditions. Start with simple strategies and gradually develop them to minimize risks. With patience and practice, a trading robot can become a reliable tool for achieving your financial goals.

FAQs

How to choose a time frame for testing a robot?

It is recommended to test the robot on several years of data, including periods of high volatility and calm markets. This will show how stable the robot is in different conditions and will help to avoid optimizing only for current trends.

Can I use multiple strategies in one robot?

Yes, it is possible to combine several strategies so that the robot can adapt to different market conditions. For example, combining a trend strategy with a counter-trend strategy can help to mitigate losses in unfavorable market phases.

How often should I update the robot's algorithm?

It is advisable to review and optimize the algorithm at least once a quarter or during sudden changes in the market. This will allow you to take into account new market conditions and minimize the robot's obsolescence.

What are the risks associated with using a trading robot?

The main risks include dependence on technical infrastructure, errors in the code and sudden changes in market conditions. It is recommended to use stop losses, regularly monitor the robot's performance and avoid overly aggressive strategies.

Related Articles

Team that worked on the article

Maxim Nechiporenko has been a contributor to Traders Union since 2023. He started his professional career in the media in 2006. He has expertise in finance and investment, and his field of interest covers all aspects of geoeconomics. Maxim provides up-to-date information on trading, cryptocurrencies and other financial instruments. He regularly updates his knowledge to keep abreast of the latest innovations and trends in the market.

Chinmay Soni is a financial analyst with more than 5 years of experience in working with stocks, Forex, derivatives, and other assets. As a founder of a boutique research firm and an active researcher, he covers various industries and fields, providing insights backed by statistical data. He is also an educator in the field of finance and technology.

As an author for Traders Union, he contributes his deep analytical insights on various topics, taking into account various aspects.

Mirjan Hipolito is a journalist and news editor at Traders Union. She is an expert crypto writer with five years of experience in the financial markets. Her specialties are daily market news, price predictions, and Initial Coin Offerings (ICO).

Forex indicators are tools used by traders to analyze market data, often based on technical and/or fundamental factors, to make informed trading decisions.

Scalping in trading is a strategy where traders aim to make quick, small profits by executing numerous short-term trades within seconds or minutes, capitalizing on minor price fluctuations.

Volatility refers to the degree of variation or fluctuation in the price or value of a financial asset, such as stocks, bonds, or cryptocurrencies, over a period of time. Higher volatility indicates that an asset's price is experiencing more significant and rapid price swings, while lower volatility suggests relatively stable and gradual price movements.

Take-Profit order is a type of trading order that instructs a broker to close a position once the market reaches a specified profit level.

Trade execution is knowing how to place and close trades at the right price. This is the key to turning your trading plans into real action and has a direct impact on your profits.